nebraska sales tax rate by city

The Nebraska NE state sales tax rate is currently 55. For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Nebraska.

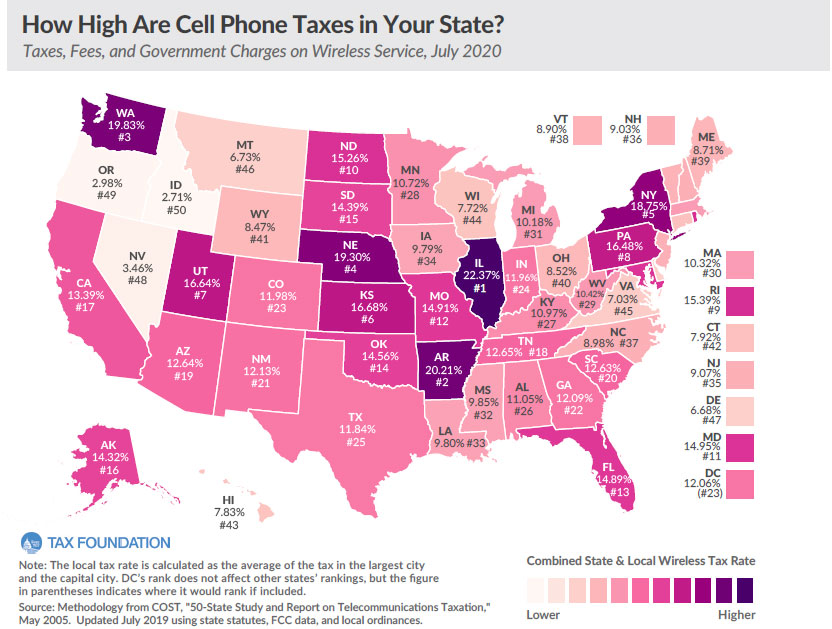

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

Did South Dakota v.

. The Gretna sales tax rate is. Several local sales and use tax rate changes will take effect in Nebraska on January 1 2019. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

January 2019 sales tax changes. A new 05 local sales and use tax takes effect. With local taxes the total sales tax rate is between 5500 and 8000.

There is no applicable county tax or special tax. Nebraska Sales Tax By County 2022 Nebraska Sales Tax By County Nebraska has 149 cities counties and special districts that collect a local sales tax in addition to the Nebraska state. Beaver City 10 65 065 141-040 03495 Beaver Crossing 10 65 065 226-041 03530.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Did South Dakota v. FilePay Your Return.

30 rows Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from. The Nebraska sales tax rate is currently.

21600 for a 20000 purchase. 536 rows 6332 Nebraska has state sales tax of 55 and allows local governments to. This is the total of state county and city sales tax rates.

Sales Tax Rate Finder. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Nebraska state sales and use tax rate is 55 055.

Groceries are exempt from the Nebraska sales tax Counties and cities can charge an. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. The County sales tax rate is.

The minimum combined 2022 sales tax rate for Dakota City Nebraska is. The Nebraska sales tax rate is currently. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

CountyCity Lottery Keno Frequently Asked Questions. This is the total of state county and city sales tax rates. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and.

2022 Nebraska Sales Tax Table. Sales and Use Taxes. The tax data is broken down by zip code and additional locality information location.

What is the sales tax rate in Dakota City Nebraska. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. Annual Sales Tax Summary 1967-2021 This table shows an annual summary of the state net taxable sales and sales tax for other than motor vehicles motor vehicles a combined state.

Our dataset includes all local sales tax jurisdictions in Nebraska at state county city and district levels. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. You can print a 725 sales tax table here.

The Nebraska City Nebraska sales tax is 750 consisting of 550 Nebraska state sales tax and 200 Nebraska City local sales taxesThe local sales tax consists of a 200 city sales. The Nebraska City sales tax rate is. The County sales tax rate is.

This is the total of state county and city sales tax rates.

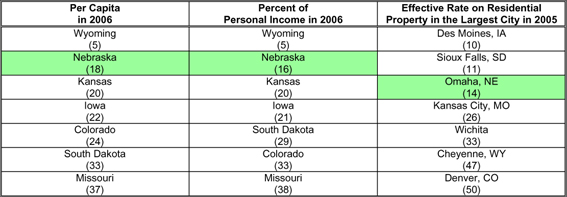

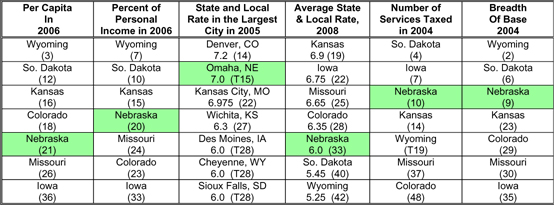

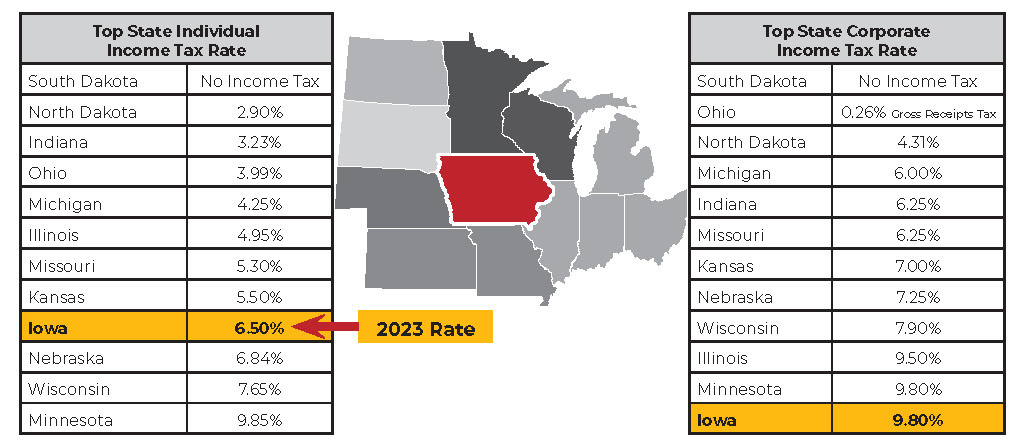

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

A Twenty First Century Tax Code For Nebraska Tax Foundation

Ricketts Wields Veto Pen Says Nebraska Needs To Save Money For Tax Cuts Nebraska Examiner

Taxes And Spending In Nebraska

Nebraska Income Tax Calculator Smartasset

Taxes And Spending In Nebraska

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nebraska Sales Tax Guide For Businesses

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Taxes And Spending In Nebraska

50 Years Ago Nebraskans Aroused To The Point Of Fury Over Taxes

Nebraska Sales Tax Small Business Guide Truic

/cloudfront-us-east-1.images.arcpublishing.com/gray/QUTHRCBRRZCUPHTE5ZM5GUA3KA.jpg)

Nebraska Legislature Debates Potential Tax Breaks

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

State Government Tax Collections Tobacco Products Selective Sales Taxes In Nebraska 2022 Data 2023 Forecast 1942 2021 Historical

Taxes And Spending In Nebraska

Nebraska Sales Tax Rate Changes January And April 2019

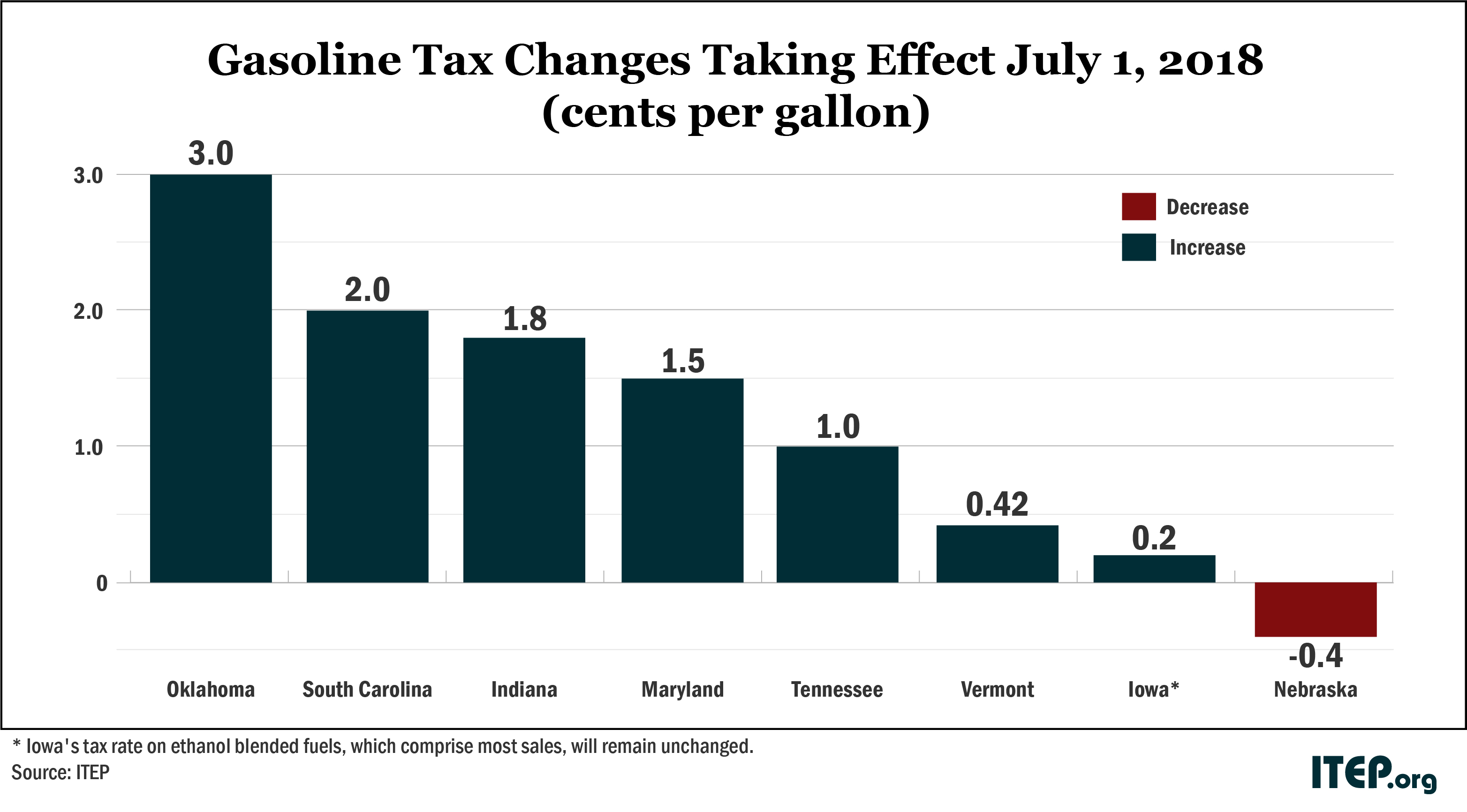

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep